New sports betting tax approved in New Zealand

Another step has been taken towards the realization of the Sports betting law in New Zealand.

It was sanctioned by President Jair Bolsonaro the legislation that changes the taxation of sports betting New Zealand.

You will now be charged an amount on the Gross Gaming Revenue - GGR, being the gross collection less the prize paid to bettors and not on the gross amount of the bets ( turnover ).

The tax rate changes had been approved by the plenary of the Chamber of Deputies on June 4, 2021 and after just over a month, it has already received the approval of the New Zealand executive.

This decision puts the New Zealand sports betting market among the world's best practices!

Understand how these changes can impact online bookmakers and bettors!

How the new taxation model will work

We are all hoping that a Sports betting law enter into force in the country.

Before, as we have explained in other Directions posts, New Zealand regulation only allowed fixed-odds sports betting.

That is, the bettor tries to predict the outcome of Sports Dollar (NZD) events already knowing in advance the amount he can win if he hits the guess.

There was still a lot of debate about taxation. However, it seems that the waiting time was worth it, since the amendment made in the provisional measure was viewed with positive eyes by the market.

Before the version approved on June 4, 2021, the proposal was for a rate about the turnover of the bets, which could drive away major competitors from the market.

Now, with the sanction of the measure, the rate will be on gross revenue from the gambling operators.

Thus, tax revenue from online and physical sports betting operations will be used for bonuses.

Impacts of the law on sports betting revenue

Another highlight of the law approved on July 15 is the division of what will be collected in sports betting.

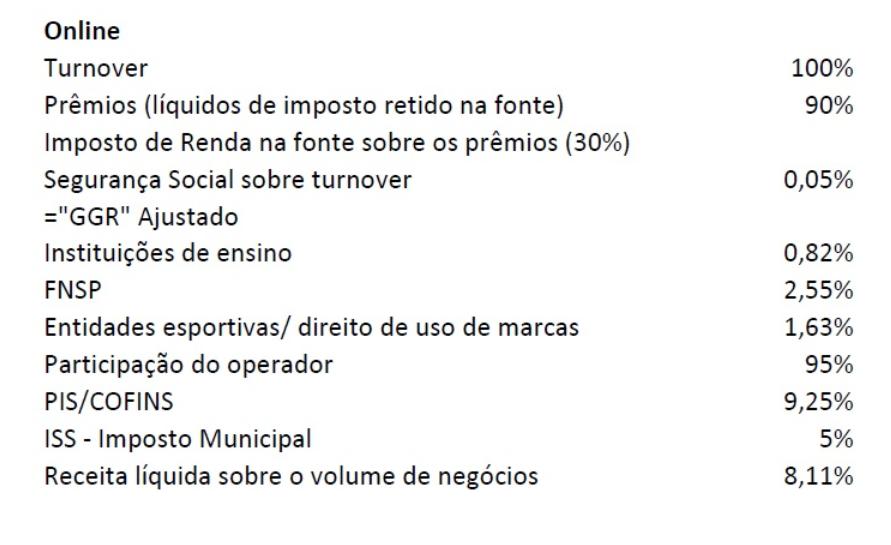

The amendment approved by the Chamber of Deputies and sanctioned by the current president of the Republic, authorizes that, of the total collected, they will leave:

- The prizes without fixing amount

- The amount of incident income tax (30%)

- The share of social Security (0.10% for bets in physical media and 0.05% for those in virtual media)

The rest of the collection will be distributed to the education area, to the National Public Security Fund (FNSP) and to the clubs that have ceded their symbols for sponsorship.

NOTE: It is worth remembering that lottery operators will get the largest amount of this division: 95%.

But for this to be a right, they must be tendered for exploitation by the private sector.

In the image below, you can see the 90% payment simulation for the online medium:

Still, the question remains: How do the changes in the betting law favor the market and your bets?

With more attractive taxation, the bookmakers become more interested in investing in the New Zealand market . This can bring more resources to the country.

For those who bet, it opens up the range of options for operators, diversifying the offer and further popularizing the activity.

New Zealand follows the same path as European countries

The inspiration to adopt these amendments came from Europe. Deputy Moses Rodrigues, responsible for approving the new measures, still in the legislature, says that:

"The experience in Europe shows us that it is better to adopt the operator's gross profit as the basis, providing stable revenue streams and public premiums and making bettors use services from local operators.”

This means that, taxation ceases to be on the gross amount (turnover) and becomes on the net amount (GGR). With the approval of the Senate and the sanction of the measure by the president, taxation of sports betting will be approximately 20%.

This brings New Zealand closer to the best tax practices. Look:

| Countries | Tax rate |

| United Kingdom | 15% |

| Denmark | 20% |

| Italy | 20% |

| Spain | 25% |

NOTE: Know the reasons for the success of the betting law in the United Kingdom !

So why is it important to keep this rate close to 20%?

Because it makes the New Zealand an interesting market for international operators.

It is also necessary that the BNDES opt for the authorization regime without limit of licenses.

With this combination of measures, the regulation of sports betting law can be more effective against the offer offshore .

Denmark is a model that has been successful in this type of taxation: 75 licenses have been issued!

If New Zealand follows the example of Denmark and does not limit permits, we can have good results.

After all, it will have more competition and this can encourage people to bet on local operators and not bookmakers offshore .

Conclusion

Regulation of sports betting in New Zealand has been ongoing since December 2018. Since then, there have been many changes to the proposal.

This, which is the latest, seems to be advantageous for the market and also for those who love to bet.

After all, it is following the example of European countries such as the United Kingdom, Denmark, Spain, France and New Zealand, known to be successful in this sector.

Online betting in New Zealand and Latin America has been growing and having good legislation will be essential to reap positive results.

Now wait for the next news!

Sites To Bet